We Raised $115k in Our First SPV! (Oct ‘25)

Note from the Founders 👋

The Girl Math of Alternatives: Lessons from our First SPV 🤑

Deal Spotlight: Realm 🌬️

Investor Resource: Returns Math ✏️

Media & Press: Girl Math’s Podcast Debut 🎧

Upcoming Events: Women in Tech (10/30) 🗓️

Note from the Founders 👋

Happy Spooky Season 🎃 from Serena, Porter, and Emma, the co-founders of Girl Math Capital! Welcome back to our newsletter, where each month, you’ll hear from us on trends in alternatives, insights from our community, and updates on what we’re building.

For those who are new here, Girl Math Capital is a membership community of 200+ women learning about and investing in alternative assets together. We hope that this newsletter gives you a sneak peak into the amazing insights shared in our community every day and gets you excited to put your money to work. Happy reading!

The Girl Math of Alternatives: Lessons from our First SPV 🤑

Read time: 5 minutes

Today we’re talking about Special Purpose Vehicles, or SPVs, and why they’re valuable to both founders and angel investors alike. Having just wrapped up our first SPV (!!) at Girl Math, we wanted to breakdown the components of the vehicle and share lessons from our first start-to-finish SPV experience.

As we highlighted in our first newsletter, Girl Math Capital currently focuses on 3 alternative asset classes: angel investing, real estate, and crypto.

In July, we came across a standout investment opportunity for the Girl Math community through a fellow investor. The company, Ghia, is a popular non-alcoholic apertif brand that has been at the forefront of the NA category since its launch.

The opportunity to invest in Ghia’s latest round quickly drew excitement from our community; so much so, that following an engaging live pitch with the founder, Melanie Masarin, we inquired about leading a Special Purpose Vehicle (SPV) for the fundraise. Deals like this one are historically shared behind closed doors, so we were so excited to be able to further our mission of increasing access to high quality alternative deal flow with this SPV.

What’s an SPV?

An SPV is a tool that founders will often use to enable angels who write smaller checks (typically <$50k) to invest in their company. In practice, SPVs are just legal entities created to hold all of the small-check angel capital, which can then be represented on a company’s cap table, or the document that lists all of the company’s investors and their ownership share, in a single line.

Instead of a founder managing dozens of small investors, they see one entry on the cap table: in this case, “Girl Math Capital SPV.” Behind that line, however, is a community of individual angels backing the same company together.

Why an SPV?

The SPV structure benefits both parties involved. Founders keep their cap tables clean and streamlined, and angels gain access to deals that might otherwise require significantly higher minimum investments. That accessibility is especially powerful for new angel investors, who can start building their portfolio, learn the investment process, and gain exposure to startups they believe in without having to write a massive check.

An SPV lead (Girl Math in this situation) is responsible for working with the founder to determine the amount of allocation for the vehicle (aka the total amount of funds you need to raise within the SPV) and gathering commitments from other accredited investors who are interested in participating in the deal. Typically, when running an SPV, the lead will work with a platform like Play Money, AngelList, or Carta to help with SPV formation, compliance, and tax preparation. For our vehicle, we worked with the team at Play Money.

Running this SPV was incredibly rewarding, as we were not only able to support a founder we believe in, but we were also able to give dozens of other women the opportunity to invest in a company they loved. We coordinated the capital for the vehicle directly from Girl Math Capital members with participation from other women-focused angel communities and were fortunate to have even more investor participation than we anticipated. Closing the Girl Math SPV resulted in Ghia hitting their fundraise target and being able to officially close their round, one were honored to have played a part in.

Our first SPV taught us an abundance of lessons, from the value of creating a thorough investment memo to how to mange a timeline and field diligence questions. Here are a few overarching themes that stood out:

Consumers love being a part of the journey. Investing offers people a unique way to engage with brands they care about: beyond buying a product, they get to participate in shaping the future of the company.

Many small checks add up. Our minimum check size for this opportunity was $500, and our average check size was $1,700. However, with 68 unique contributors, our collective impact was huge.

Expanding access creates impact. Opening up an investment opportunity to a broader audience doesn’t just diversify the cap table, but also enriches the company’s collective brain trust. The investors who participated in the Girl Math Capital SPV bring experience across industries and functions, giving founder Melanie access to a uniquely versatile network to tap as Ghia grows.

Beyond capital, these investors have become Ghia superfans, proudly stocking the brand at events, recommending it to friends, and amplifying its story across their own networks. In expanding who gets to invest, we also develop a tighter relationship between the product and its consumers.

Deal Spotlight: Realm 🌬️

ICYMI: Each month, we’ll share a few of the deals our community has backed, not to give investment advice, but to show you the breadth of opportunities Girl Math members are exploring and spotlight some epic founders.

During the summer of 2024, we met Ashley Sweeney, a four-time founder shaking up a billion dollar industry that’s lacked innovation for the past 80 years: air care. Pre-launch, Ashley had a bold vision to create a new standard for air products, one that was clean, sustainable, and safe for everyday use. Six Girl Math Capital members invested through an RUV (Roll Up Vehicle, or a type of SPV led by the founder) and cheered her on as she developed Realm and her hero product.

Fast forward to September 17th, and Realm launched its signature air and fabric spray, available in four scents and accompanied by its own safety certification, Safe Scent Certified. Realm’s hugely successful launch is a testament to Ashely’s grit, determination, and vision, and we know this is just the beginning.

Shop Realm here using code REALMGMC15 and read Inc. Magazine’s launch coverage here.

Investor Resource ✏️

Returns Math

from Girl Math speaker Abby Meyers

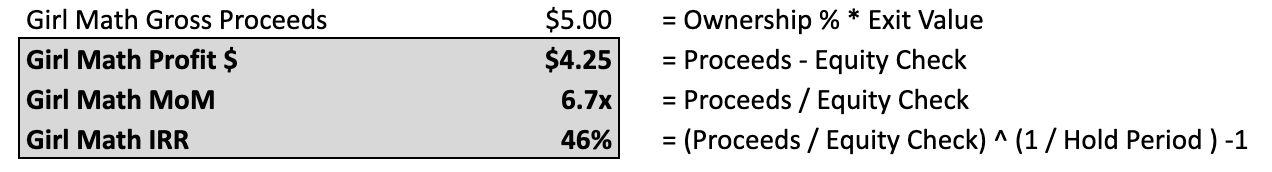

In early October, we had the pleasure of hosting Abby Meyers, Partner at Bain Capital Ventures, to lead a deep dive into venture math, covering everything from cap tables and valuations to dilution and returns. Below is a snippet from this session on how we would calculate our returns on a company we’re exiting.

Let’s say we invested $750k into a company. If the company IPOs or sells to a strategic 5 years later for $2 billion dollars, our $750k equity would then represent 0.25% of the company. Owning 0.25% of the company would make our proceeds equal to $5M ($2 billion * 0.25%). If our original check size was $750k, our earnings would $4.25M ($5M - $750k). We measure our returns in MoM and IRR.

MoM = Multiple of Money; compares the equity we get upon exit vs. the equity we put in. Our MoM is 6.7x ($5M / $750k).

IRR = Internal Rate of Return; indicates the annualized rate of return an investment is expected to generate, factoring in the timing of the equity you put in and when you get it back. Here, our IRR is 46% ( ($5M/$750k) ^ (1/5)-1 )

For more tips like this, consider joining our next cohort!

Media & Press: Girl Math’s Podcast Debut 🎧

Ungatekeeping Angel Investing

This month, Emma Pratt joined Eline de Wit on the MOXIEPOD to break down the world of alternative investing: why it matters, how to approach it, and ways to balance it alongside more traditional investments. They also dive into Girl Math Capital’s founding story, unpack the data behind the persistent wealth gap, and discuss how we’re working to change it. Listen on Spotify or Apple Podcasts.

Disrupting Finance and Founders

Serena Ainslie joined Patrick Leddin on the Disruption Lab to explore how we’re re-writing the rules of investing and entrepreneurship. They discuss the unique challenges female founders face in raising capital, why redefining risk is key to innovation, and how data, intuition, and courage come together in the investment process. Listen on Spotify or Apple Podcasts.

Upcoming Events: Women in Tech 🗓️

On Thursday, October 30th from 6 to 9 pm, we’re hosting a Women in Tech Happy Hour in partnership with Scale Venture Partners and FemBuild Collective.

This isn't your typical happy hour. We'll have a few prompts floating around to make it easy to find your people and strike up conversations on topics like fundraising, career pivots, and community building. Plus, we’ll have a poster-making station for the NYC Marathon!

Come for appetizers, drinks, and so much more. RSVP here!

Closing Note 💌

Girl Math Capital was born from the frustration that deals were shared in some circles and not in others. This newsletter is one more way to make sure those conversations and opportunities reach more people, and in particular, more women. If you know someone who’d love this newsletter, pass it along. We believe alternative investing isn’t just for finance and tech bros - it’s for women who want to get smart, build community, and build generational wealth. See you next month 💸💅

The Girl Math Team

If this got you curious, submit your information to join our next cohort, or apply to be a community member here.