Cohort Three Loading… (Nov ‘25)

Note from the Founders 👋

The Girl Math of Alternatives: The Rise of the Female Investor 👩💼

Deal Spotlight: Goodword 🤝

Investor Resource: Real Estate Risk & Reward 🏘️

Media & Press: All Things Fashion Tech 👗

Upcoming Events: The Girl Math of Prenups (11/24) 💍

Note from the Founders 👋

GM ☕ from Serena, Porter, and Emma, the co-founders of Girl Math Capital! We’re so thrilled to share that Cohort 3 applications are LIVE through December 1st! Apply now to be a part of our growing community of women in alternative investing.

For those who are new here, welcome! We hope that our newsletter gives you a sneak peak into the amazing insights shared in our community every day and gets you excited to put your money to work. Happy reading!

The Girl Math of Alternatives: The Rise of the Female Investor 👩💼

Read time: 3 minutes

Our social media algorithms may be slightly biased, but it’s increasingly clear the number of female investors is steadily on the rise. Personal wealth management has traditionally been a blue job (watch: blue job vs. pink job), but that’s changing day by day. In 2020, women controlled $11 trillion or 29% of total US household financial assets.¹ By 2030, that’s predicted to grow to $34 trillion or 38%.²

Let’s break down why.

The Great Wealth Transfer. Trillions of dollars are expected to change hands from baby boomers to younger generations. This shift will start with “horizontal” wealth transfers - wives who are younger and/or outliving their male spouses - and then will flow down to Gen X and Millenials.

More women becoming high earners in the workplace. Women now make up a growing share of six-figure earners, hold a record number of advanced degrees, and are entering leadership roles at higher rates than any previous generation.

The emergence of platforms democratizing access to investing. Across both traditional asset classes and alternatives, a growing ecosystem of technology tools and educational resources (Girl Math included!) is making it easier for people to learn about, participate in, and build wealth.

These factors create the perfect storm for female investors to take charge and make an impact. We’ve seen that when women get to write checks, the pipeline of who gets funded starts to look very different.

Many of you may be familiar with the statistic that only about 2% of US venture capital funding goes to female founders.³ That gap stems from a mix of investor bias (both conscious and unconscious), limited access to established deal-flow networks, pattern-matching around historically male founders, and a structural lack of women in decision-making roles. It’s especially difficult for women-only teams to get in front of investors when they’re building products for women (period and menopause care, fertility, motherhood, and beyond).

When more women are in the decision-making seat writing checks, more diverse perspectives get funded, more overlooked ideas get a fair shot, and more products built for women actually make it into the world.

Girl Math Capital exists to move this change forward - to give women the tools they need to evaluate opportunities and to connect incredible founding teams with incredible angels. If you’ve been curious about angel investing and want to back more diverse, mission-driven founders, or you’re looking to learn more about real estate investing or crypto, there’s no better time than the present. Cohort 3 applications opened Monday and will remain open until Monday, December 1st. By joining our third cohort, you’ll embark on a four-month curriculum that breaks down these asset classes alongside a group of equally ambitious women. You’ll get to access our deal flow, invest alongside us, join our in-person and virtual events, and become part of a community of women building wealth together.

Apply to join us, or if you’re already a member, forward this newsletter to someone else who should.

The future of investing is female. 💪

Deal Spotlight: Goodword 🤝

ICYMI: Each month, we’ll share a few of the deals our community has backed, not to give investment advice, but to show you the breadth of opportunities Girl Math members are exploring and spotlight some epic founders.

Back in January, we met Caroline Dell and Chris Fischer through Alex Chung, who was at the time an investor at Chai Ventures. They were building a networking co-pilot designed to turn relationships into opportunities - intelligently organizing your network, surfacing the right people at the right time, and prompting you to take action.

Thanks to Kate Brodock and Katie Dunn, we were able to invest through a special purpose vehicle (SPV), the same structure we broke down in our October newsletter.

Over the past several months, Caroline and Chris have continued iterating and leveling up their product and strategy - including a key hire: Alex as Founding Head of Growth. In October, the team officially brought Goodword to market, and we’ve loved watching a product this needed come to life. At Girl Math, we’re proud to be betting on AI tools that strengthen human connection, not replace it.

Download Goodword here using code GWGMC5 to join Goodword as a Founding Connector, and read more about Goodword’s launch here!

Investor Resource ✏️

Real Estate Risk & Reward 🏘️

from Girl Math speaker Heather Mewkill

In late October, Cohort 2’s very own Heather Mewkill led the first of two Real Estate sessions. In this edition’s investor resource, we’re breaking down the four main real estate investment strategies she shared with us.

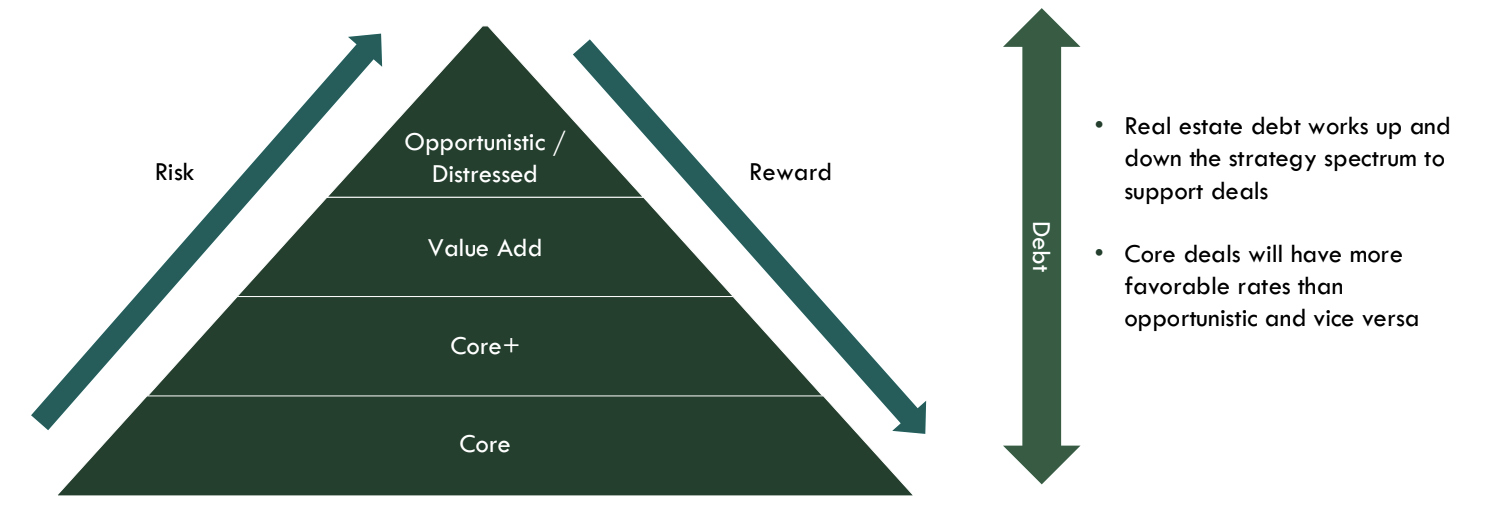

Just like with any investment, risk and reward are directly correlated when it comes to real estate properties and real estate debt. Commercial real estate opportunities will fall into one of four categories: core, core plus, value add, and opportunistic.

Core: Low risk, low reward. These properties generate predictable cash flows and are typically located in strong markets with stable tenants

Core plus: Slightly higher risk with slightly higher reward. Generally well-located with reliable tenants, but may carry minor risks like lease renegotiations or light building updates.

Value add: Higher risk, higher reward. Investors buy a property and improve it: renovating the building, optimizing management, upgrading tenants, or restructuring leases.

Opportunistic/Distressed: Highest risk, highest reward. Often involves major redevelopment, new construction, or distressed assets. Returns can be significant but require patience and a strong financial cushion.

For more tips like this, consider joining our next cohort - apps are open now!

Media & Press: All Things Fashion Tech 👗

Pulling Back the Curtain on What Fashion Tech Investors Really Want

This month, Emma Pratt was quoted in Emma Rayder’s article in All Things Fashion Tech, a must-read on what the next generation of consumer tech investors are excited about.

“I look for fashion tech companies building solutions that are deeply personalized, convenient, and powered by AI. The most compelling teams are driving sustainability through smarter systems.” 📰 Read the full issue here.

Upcoming Events: The Girl Math of Prenups 💍

The Girl Math of Prenups: Navigating Marriage with Confidence

We polled our members to see what topics they wanted to explore beyond our core curriculum. What came out on top was prenups, and we knew the perfect person to call.

Leading our prenup conversation is Lilli Donahue, founder of The Prenup Podcast, who’s building a stealth solution transforming how couples approach marriage planning. She’ll be joined by two incredible matrimonial and family law attorneys, Ruth Chung and Shari Bernstein, who will break down what prenups actually are, how to approach them, and what to keep in mind as you plan for your future.

Whether you’re married, engaged, in a serious relationship, or just curious about your options, we’re diving into a topic that’s often considered taboo, and we couldn’t be more confident that these ladies will make it equally fun as it will be informative. Open to the public - please join us on Monday, November 24th at 6:30 pm ET, virtually or in person in NYC! RSVP here.

Closing Note 💌

Girl Math Capital was born from the frustration that deals were shared in some circles and not in others. This newsletter is one more way to make sure those conversations and opportunities reach more people, and in particular, more women. If you know someone who’d love this newsletter, pass it along. We believe alternative investing isn’t just for finance and tech bros - it’s for women who want to get smart, build community, and build generational wealth. See you next month 💸💅

The Girl Math Team

¹ McKinsey & Company: Women as the Next Wave of Growth in US Wealth Management

² Robb Report: Women Will Control $34 Trillion in U.S. Assets by 2030: Report

³ Harvard Kennedy School: Advancing Gender Equality in Venture Capital

If this got you curious, apply to our third cohort, or apply to be a community member here.